Life Insurance in and around Prescott Valley

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Prescott Valley

- Prescott

- Dewey

- Chino Valley

- Quad Cities

- Arizona

Check Out Life Insurance Options With State Farm

Choosing life insurance coverage can be a lot to think about with many different options out there, but with State Farm, you can be sure to receive empathetic reliable service. State Farm understands that your primary reason is to help provide for your family.

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Put Those Worries To Rest

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Scott Smith stands ready to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

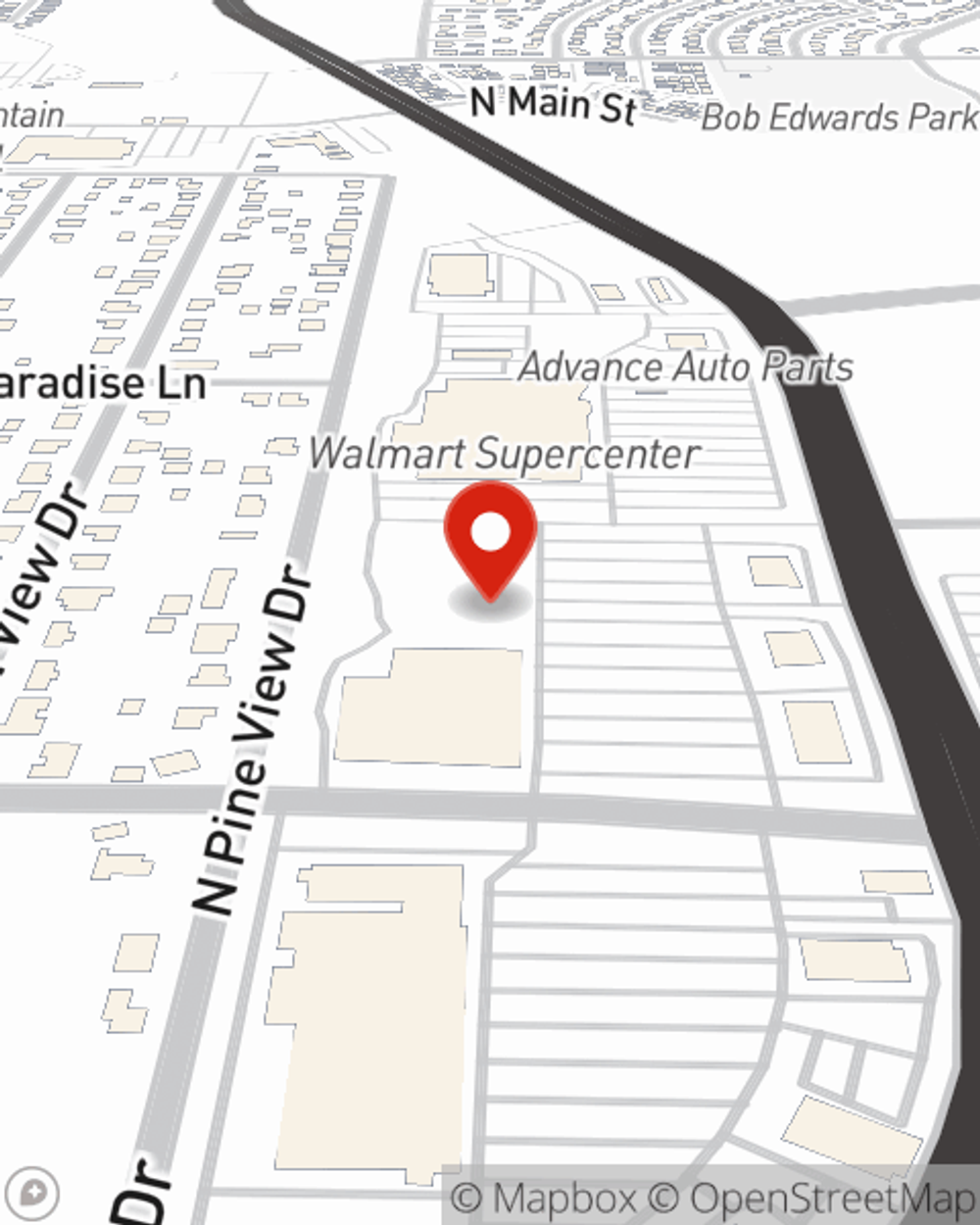

Get in touch with State Farm Agent Scott Smith today to experience how a State Farm policy can ease your worries about the future here in Prescott Valley, AZ.

Have More Questions About Life Insurance?

Call Scott at (928) 772-7100 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Scott Smith

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.